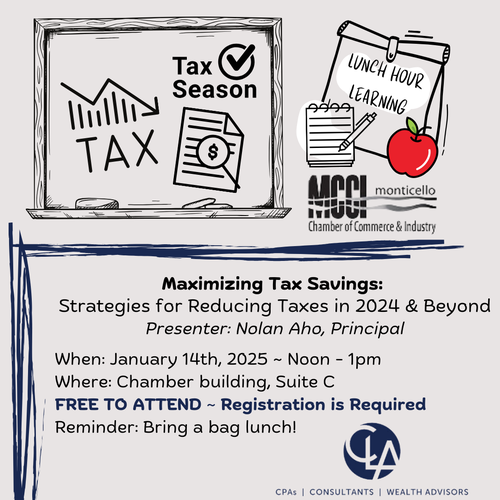

Date and Time

Tuesday Jan 14, 2025

12:00 PM - 1:00 PM CST

Location

118 W 6th St Suite C

Monticello, MN 55362

Fees/Admission

Free to attend

Description

Lunch Hour Learning ~ Maximizing Tax Savings: Strategies for Reducing Taxes in 2024 and Beyond

Join us for an insightful session where we will delve into effective strategies for reducing your tax burden in 2024 and beyond. This presentation is designed to equip business owners and professionals with the knowledge and tools needed to maximize tax savings.

Nolan Aho with CLA (CliftonLarsonAllen) will be covering topics such as:

- Reducing Volatility of Income: Learn techniques to stabilize your taxable income and minimize tax liabilities through strategic planning.

- Allowable Business Expenses: Discuss what types of business expenses are deductible and how to properly document and claim them to reduce your taxable income.

- Write-Offs: Understand the various write-offs available to and how to effectively utilize them to lower your tax bill.

- Tax Credits: Explore some of the more common tax credits available and how to qualify for and claim these credits to further reduce your tax obligations.

Don't miss this opportunity to gain valuable insights and practical tips that can help you navigate the complexities of the tax system and achieve significant savings. Register now to secure your spot and take the first step towards a more financially secure future!

Images